Comment :

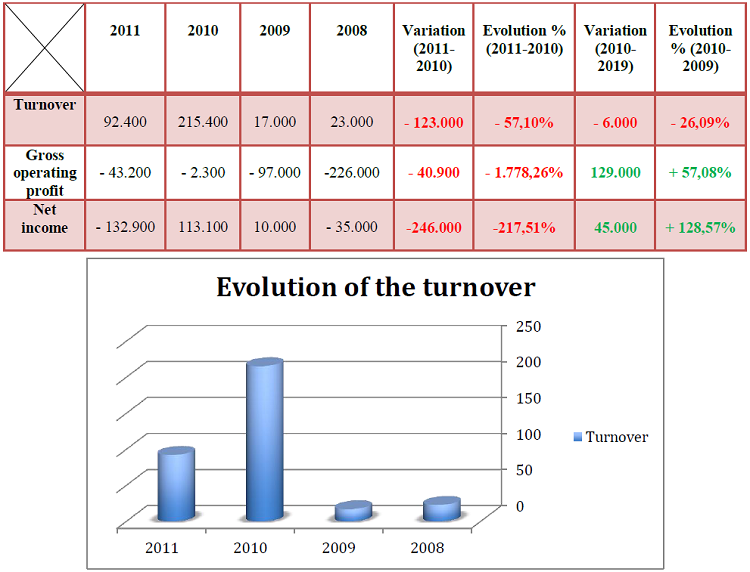

We observe a large difference between the turnover in 2010 and 2008, 2009 and 2011. Indeed, the year 2010 corresponds to the participation of the company in the Shanghai World Expo. This event allowed the company to increase contacts but also sales. The sharp drop in 2011 is due to some miscommunication, which caused falling sales and hence revenue. The company did not then bounce up with demand, and has not taken advantage of the publicity in 2010 to solicit new customers and increase sales volume.

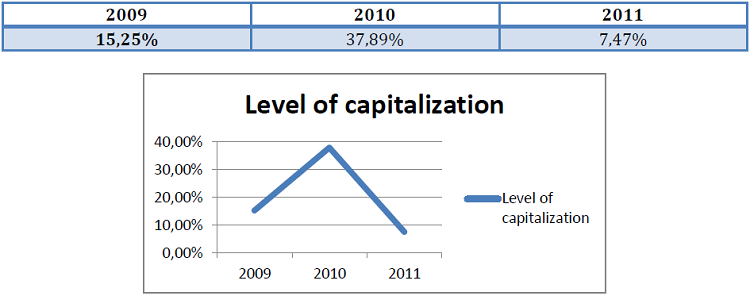

a) Level of capitalization

Comment: The level of capitalization of a company provides a first assessment of the wealth accumulated by the company during its existence. More equity is higher, and more the company has a cushion of assets (land, buildings, inventory, receivables, cash…) to allow possibly repay all its debts (bankers, suppliers, region and state…).

We can notice that the year 2010 was good for business, but in 2011 it appears that the company has struggled to repay these debts, owed to a decline in turnover and therefore a lack of funds available to repay these debts. A ratio between 5 and 15% shows that the company is in danger but it can reach to catch up on the second year. In 2011, with a ratio of 7.47%, the company takes great risks to not being able to repay its debts and in the worst cases, bankruptcy.

Therefore following the publicity generated by the World Expo in Shanghai, 3D event, must base on this recognition, address book and already rich to enter the Chinese market and hope to acquire new shares of market and avoid bankruptcy. I therefore recommend the company to develop a clear communication plan over the long term, but also to approach new markets in order to search new clients, such as BRIIC countries where opportunities are great, especially for new innovative technologies.

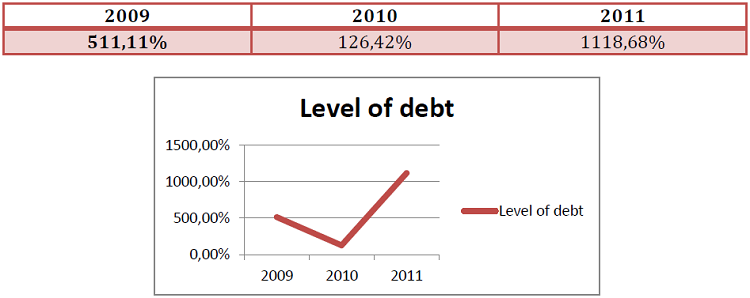

b) Level of debt

Comment : This ratio ensures that the members of a company are more involved financially. If borrowings are substantially more than 100% of the equity, this imbalance may mean that the partners have limited financial means or do not wish to invest in the company.

From the data that we have, once again the year 2010 was a very good year for the company. However in 2011, it seems that the main shareholders of the company have chosen not to invest or whether they did not have enough funds to finance projects. It could be more than the company has chosen to expand, to have new premises where a high level of debt as a result of organizational restructuring. After the year 2010, the company is therefore chosen to borrow to acquire new market share, the company is not able to bounce back against the entry of new competitors or to better optimize sales competition. In addition, the company invests more than 10% of its turnover in research and development, which in part explains the poor results this year, as sales were pretty good in 2010 due to an input noticed in the Chinese market, the company must locate and find customers wishing to discover technological prowess developed by the company.

The debt level is also an indicator for customers, since the financial crisis, buyers are pickier about the figures published by the companies. Therefore it is important for organizations to communicate more about these projects in the short, medium and long term in order to reassure buyers on the outlook for the company.

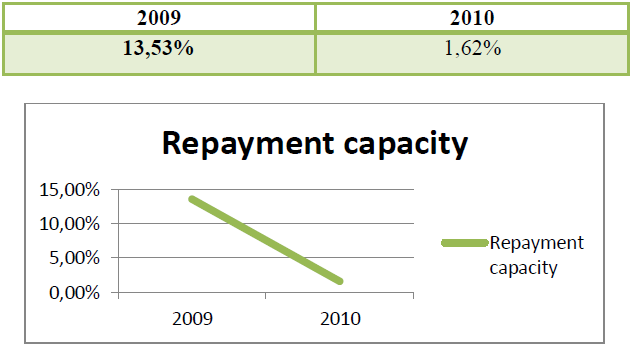

c) Repayment capacity

Comment : This ratio evaluates the theoretical number of years required to repay all of the bank debt of the company. Beyond 5 to 7 years, which is the maximum current bank loans, this ratio can alert the difficulty to repay its bankers.

In 2009, the company seemed to be in a dangerous position, the ratio shows that it would have taken almost 14 years to repay these debts. In 2010, after more than satisfactory results the repayment period has been greatly reduced from almost 2 years. Therefore we imagine that in 2010, 3D event was able to repay these entire debts bank. But due to the poor results of 2011, it seems that during this year, the company accumulated debts that they do not be able to pay on time. A study of the results of 2012, we would compare with the year 2011 and to understand what strategy the company has chosen to take.

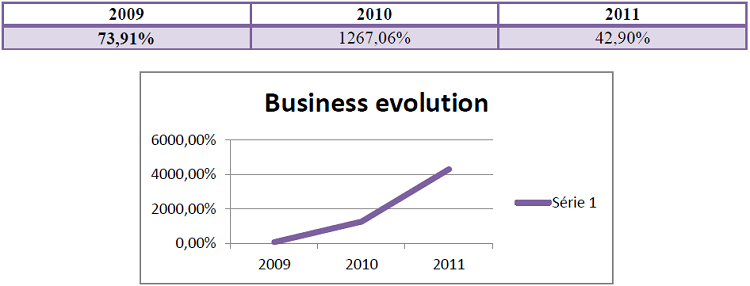

d) Business evolution

Comment: The analysis of the variation of the turnover to check if the company has growth at least as important as the French economy in general. Above a positive growth rate of 2%, we can consider that the company manages favorably to “grow” at the same pace or stronger than the average French economic actors.

We observed through this ratio, the 3D Event has managed the financial crisis that occurred in Europe. The turnover in 2011 was worse than in previous years still shows that the company is doing well in comparison to French economic actors. The result is set in 2011 shows that the company has accumulated debts as a result of organizational development which could be explain that the company has lost customers due to poor follow-up or miscommunication. The 2010 event has allowed the company to know a new market and therefore to establish them, which requires substantial resources in terms of people, technology, communication…

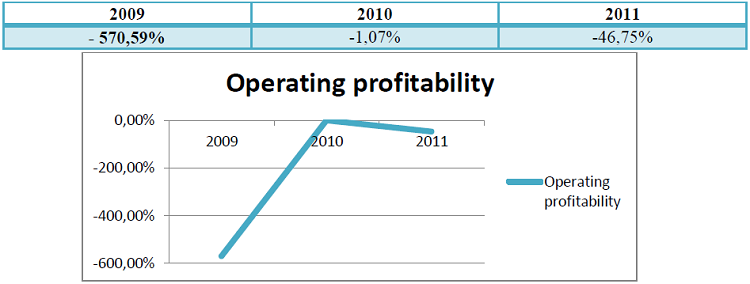

e) Operating profitability

Comment : EBITDA is profit earned by the company through its core business. It ensures that the “core business” of the company is profitable, before taking into account costs indirectly related to daily activities, such as the annual depreciation of the equipment or the payment of interest of bank debt.

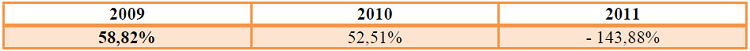

f) Net profitability

Comment: The ratio Net income / turnover considers the ability of the company to reach a final net profit, after taking into account all of the expenses that were incurred by the company throughout the year.

We note that during the years 2009-2010 the company was profitable with a very satisfactory rate much higher than 1%. In 2011 the financial situation of the company seems particularly degrade with an increase of 19.38% of its debt. In addition, we can see that exports down 57% and the production company also lowered by 59.41%. With as sharp a decline, the profitability is compromised and must respond quickly and try to find ways to increase exports and increase turnover.

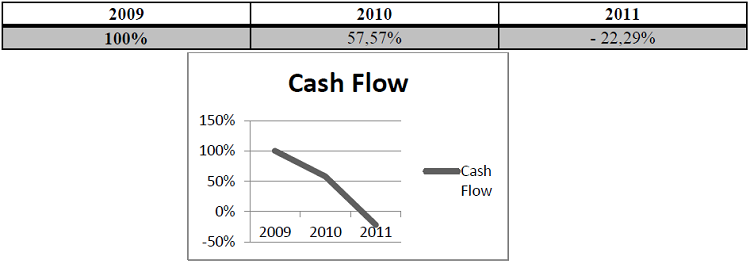

g) Cash flow

Comment : Cash flow gives an indication of the company’s ability to generate enough cash to overall power then maintain or expand its business. Negative cash flow means that the company will tend to have less cash likely “to strangle” gradually its business.

2011 is a year for the company rather negative 3D Event that records a negative ratio of 22.29%, which shows the difficulties for the company to finance its operations in the future and then the risk of bankruptcy if solutions are not implemented quickly. What is surprising is rare and in 2009 the company recorded a Cash flow equal to 100% which could be explained that the company’s customers have honored their purchase and in a timely manner. To improve a negative Cash flow, the company can increase its gross savings.

Conclusion

The company 3D Event is losing market share, and financial situation seems unfavorable. Indeed, companies are increasingly restrictive to invest on heavy communication. Holography is little known and little used, so it needs strong support and canvassing every day. Reserved almost exclusively for companies with high budget and timely manner, it is difficult to establish itself as a leader in a market still new and little known to the general public. To survive in the competitive environment, the company must diversify these offers, and not focus on a niche market that is still widely used. The biggest challenge for a company that invests in a new market is to have financial reserve as important to be able to organize all aspects of the implementation of the market, and this generally requires several competitors in order to establish market rules.

I think the events holography has capacity for growth on a long-term. It may be commonplace in the future, but it takes time, research and especially communication. The challenge for a company like 3D Event is to reduce the cost of leasing products to open the market for more economic actors. More to support its growth, it needs to diversify into other areas, such as holographic protection which is a growing market.