Before presenting the results and empirical implications of the model, I should

describe the different steps and the methodology I used to obtain the final specification:

1st Step: using the AAII and II weekly sentiment indicators, I calculate three investors

sentiment measures: bullish proportion (% of bullish investors / % of bullish and bearish

investors), bullish-bearish Spread (% of bullish investors – % of bearish investors) and the

bullish bearish Ratio (% of bullish investors/ % of bearish investors). From these 3 possible

measures, I should find the best measure of sentiment and the model that best explains the

data. I try to construct 3 models, each one contains all the variables with one of the 3 possible

sentiment measures, so every specification contains 17 explanatory variables with a constant:

Underwriter reputation, Overhang ratio, R&D intensity, VC backed, Firm age, Firm size

Ln(assets), Firm size Ln(sales), Issue size, Firm profitability, ROA, Issue risk (tech dummy),

Insiders’ ownership, Institutional ownership, Blockholders’ ownership, AAII sentiment

indicator, II sentiment indicator and Time dummy.

The regression results and the models adjustment quality and different measures of goodness

of fit allow the choice of the model containing the bullish bearish Ratio as the model that best

explains underpricing within the sample and using these control variables: the highest Rsquared

and adjusted R-squared which measure the success of the regression in predicting the

values of the dependant variable within the sample, and the lowest Akaike Information

Criterion and Schwarz Criterion which are measures of the goodness of fit of an estimated

statistical model and they measure the efficiency of the parameterized model in terms of

predicting the data. So in a first step, I continue working with the model using the Bullish

Bearish Ratio as measure of investor sentiment with all the other explanatory variables.

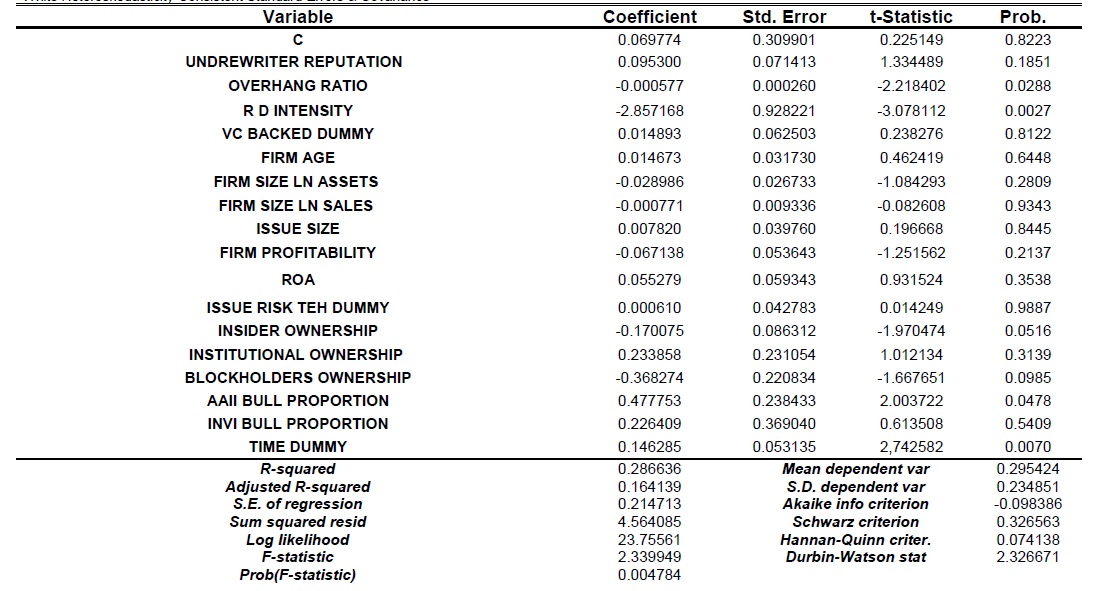

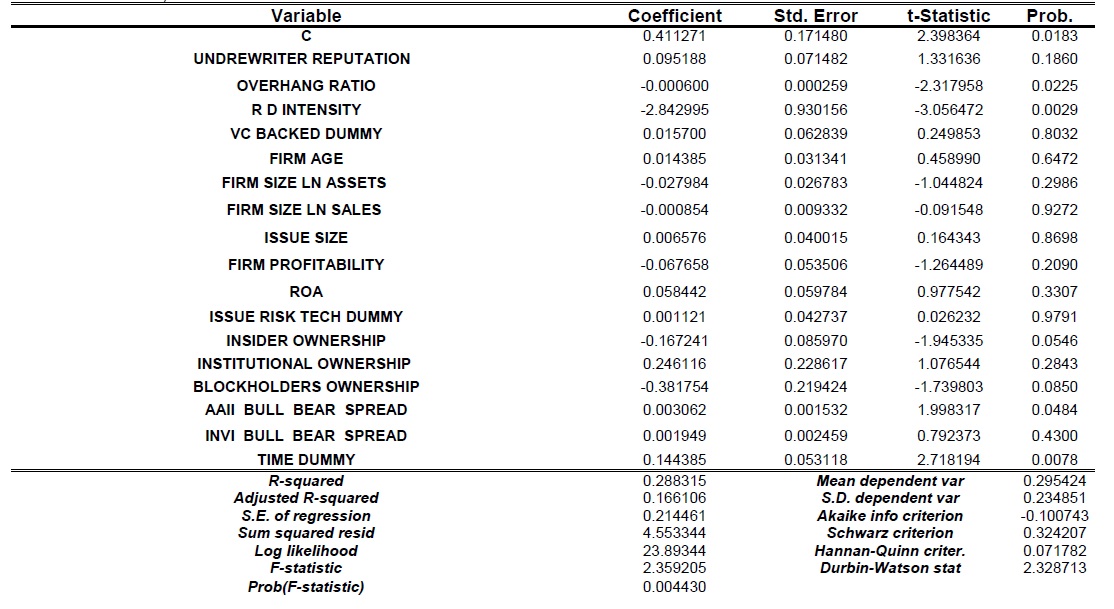

The tables 6 and 7 present the regression results of the models containing all the variables

with respectively the bullish proportion and the bullish-bearish spread as measures of

investors’ sentiment. The tables also contain criterion used to decide which model explains

best the dependant variable within the sample.

Table 6. Ordinary Least Squares Regression Results (with Bullish proportion as investors’ sentiment measure)

Dependent Variable: UNDERPRICING

Method: Least Squares

Sample (adjusted): 1 214 Included observations: 117 after adjustments

White Heteroskedasticity-Consistent Standard Errors & Covariance

Table 7. Ordinary Least Squares Regression Results (with Bullish Bearish Spread as investors’ sentiment measure)

Dependent Variable: UNDERPRICING

Method: Least Squares

Sample (adjusted): 1 214 Included observations: 117 after adjustments

White Heteroskedasticity-Consistent Standard Errors & Covariance

2nd Step: I check the correlation between the explanatory variables, I use Klein

correlation detection criterion: comparison between R-squared (R²) and the different squared

simple correlation coefficients (r²) with r²=Cov²(Xi,Xj)/ Var(Xi)*Var(Xj)

r²

Xi,Xj > R² for i≠j means the presence of correlation between Xi and Xj.

For this, I should use the correlation matrix to determine the different correlation coefficients

between all the explanatory variables. For R² = 0.2897, I find a correlation between issue size

and firm size Ln (assets) (r²= 0.4361) and a correlation between institutional ownership and

blockholders’ ownership (r²= 0.8326). I construct all the specifications necessary to decide

which control variables I should eliminate and which explanatory variables I should keep in

the model to give the best explanation of underpricing phenomenon (the dependant variable

of the model). Founding my decision on measures of goodness of fit and of adjustment quality

for the model, I eliminate issue size and institutional ownership, and I keep all the other

control variables. The final specification contains 15 explanatory variables: Underwriter

Reputation, Overhang Ratio, R&D Intensity, VC Backed, Firm Age, Firm Size Ln(assets),

Firm Size Ln(sales), Firm Profitability, ROA, Issue Risk (tech dummy), Insiders’ Ownership,

Blockholders’ Ownership, AAII Bullish Bearish Ratio, II Bullish Bearish Ratio and Time

Dummy.

With a new correlation matrix, I check the correlation between these 15 control variables:

r²

Xi,Xj < R² = 0.2833 for i≠j

There is no correlation between the control variables after eliminating issue size and

institutional ownership.

The final specification is as follows:

Underpricing = a0 + a1Underwriter Reputation Dummy + a2Overhang Ratio+ a3R&D

Intensity + a4VC Dummy + a5Ln (1+age) + a6Ln (assets) + a7Ln (sales) + a8Firm

Profitability + a9ROA + a10Issue Risk Dummy + a11Insiders’ Ownership + a12

Blockholders’ Ownership + a13Individual Bullish Bearish Ratio+ a14Institutional Bullish

Bearish Ratio + a15Time Dummy + εi

With underwriter reputation, overhang ratio, R&D intensity and VC backing used to measure

the informational asymmetry and exactly are proxies for the firm quality. Age, firm size, firm

profitability, ROA and issue risk are measures of risk. Insiders’ ownership and blockholders’

ownership are proxies for issuer bargaining power. Individual and Institutional bullish bearish

ratios are measures of investors’ sentiment. Finally, time dummy is a control variable to

verify the impact of the beginning of the financial crisis on IPO underpricing.

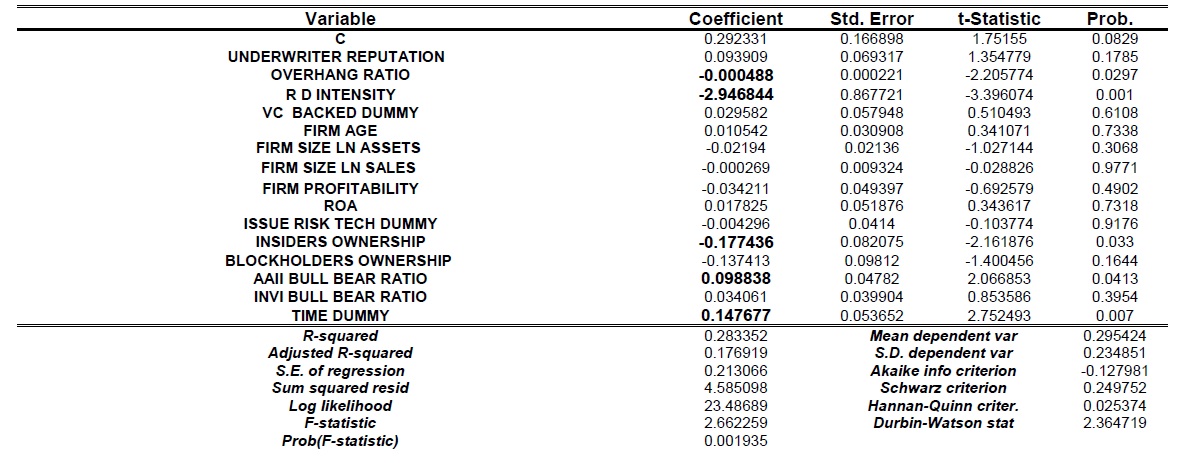

I present the Ordinary Least Squares regression results in table 8. The first result is that the

model is statistically significant (p.value= 0.001935), which means the relevance of the

control variables used in this model to explain the underpricing phenomenon (the dependant

variable). I find acceptable values of Akaike Information Criterion and Schwarz Criterion

which measure the goodness of fit and the efficiency of the parameterized model in terms of

predicting the data.

Let’s verify the individual significance of the explanatory variables. 5 statistically significant

variables: Overhang Ratio, R&D Intensity, Insiders’ Ownership, Individual Bullish Bearish

Ratio and Time Dummy.

The negative and significant coefficient of insiders’ ownership is consistent with the

hypothesis that issue firms with high bargaining power request higher offer prices conducting

lower degree of underpricing. This negative relation between issuer bargaining power and

underpricing is consistent with the findings of Ljungqvist, Nanda and Singh (2003),

Ljungqvist and Wilhelm (2003), Loughran and Ritter (2004) and many other researchers who

used this variable in their studies.

The positive and significant coefficient of Individual Bullish Bearish Ratio is consistent

with the hypothesis that investors with high and optimistic sentiment are willing to pay higher

prices to acquire the IPO shares leading to higher underpricing. This result is consistent with

the findings of researchers who are interested in the behavioral explanation of IPO first day

price run up using different proxies for sentiment: Lee, Shleifer and Thaler (1991) with

discount on closed-end funds, Cornelli, Goldreich and Ljungqvist (2004) with grey market

prices and many other researchers using the behavioral approach and the investor sentiment.

The positive and significant coefficient of Time dummy presents the positive relation

between underpricing and the beginning of the financial crisis which has an impact on the

IPO first day returns.

The negative and significant coefficients of overhang ratio and R&D intensity (both are

measures of firm quality) can be explained by the fact that high quality issue firms request

higher offer prices for their IPOs conducting lower level of underpricing.

The lack of significance of the 6 measures of risk (age, Ln(assets), Ln(sales), firm

profitability, ROA and issue Risk (tech dummy)) is consistent with the findings of Bartov,

Mohanram and Seethamraju (2003): using a dummy variable for risky IPOs, they find that

there is no correlation between risk and underpricing and the notion of risk can not explain the

setting of a lower offer price and then the underpricing phenomenon.

The lack of significance of the VC backing coefficient confirms the findings of many

researchers that used VC dummy as a proxy and as a signal for firm quality. A question can

be asked about the explanatory power of this variable and its introduction in explanatory

models of underpricing phenomenon.

By regrouping the three theories advanced earlier as explanations for the underpricing

phenomenon in the same model and by using different proxies for each theory, I show that:

The informational asymmetry theory and particularly the issuing firm quality proxied by

R&D intensity or by the overhang ratio presents a relevant explanation to the short run IPO

anomaly.

The issuer bargaining power proxied by insiders’ ownership is also an important and a

reliable determinant of underpricing.

Finally, one of the main goals of this study is to show the relevance and the importance

of investors’ sentiment and behaviour as an explanation to the short run IPO puzzle, and to

find the positive correlation between the investors’ optimism and underpricing phenomenon.

This hypothesis is confirmed in this study.

In this model, I distinguish between the two types of investors: individual and institutional

investors using a direct measure of sentiment for each type calculated from the American

Association of Individual Investors and the Investors Intelligence survey data, these are two

other contributions in this study. The positive and significant coefficient of individual

investors’ sentiment and the positive but insignificant coefficient of institutional investors’

sentiment lead to an important finding: individual investors are those driving the first day

closing prices and then underpricing anomaly and are more conducting the short run IPO

puzzle than the institutional investors. The individual investors’ sentiment and their over

optimism and enthusiasm is more important and relevant in explaining the IPO underpricing

anomaly than does the institutional investors’ sentiment. Individual investors are the type

more conducting the IPO first day returns and the short run IPO puzzle.

This finding can be explained by the fact that in some researches and studies, institutional

investors are defined as rational investors. This can be a possible explanation for the

irrelevance of institutional investors’ sentiment in explaining the underpricing anomaly.

Table 8. Ordinary Least Squares Regression Results

the percentage first-day return from the offer price to the first-day closing price. The underwriter reputation dummy takes a value of one if the lead underwriter has an updated Carter and Manaster (1990) rank of 8 or more, and zero otherwise. Share overhang is the ratio of retained shares to the public float (the number of shares issued). R&D intensity is the ratio of Pre-IPO R&D expenditures to the expected market value.

The VC dummy takes a value of one (zero otherwise) if the IPO is backed by venture capital. Ln(1 + age) is the natural log of 1 plus the years since the firm’s founding date as of the IPO. The Ln(assets) is the natural logarithm of the pre-issue book value of assets expressed in millions $. Ln(sales) is the natural log of the firm sales a year prior the offering, expressed in millions $. Firm profitability is the ratio of Pre-IPO EBITDA to total assets value.

ROA is the ratio of Pre-IPO net income to total assets value. The issue risk is a tech dummy takes a value of one (zero otherwise) if the firm is in the technology business. Insiders’ ownership and blockholders ownership are proxies to ownership structure and issuer bargaining power.AAII and II bullish bearish Ratios are the % of bullish investors divided by the % of bearish investors. Time dummy takes a value of one (zero otherwise) if the IPO occurred after July 2007. The t-statistics are calculated using White’s (1980) heteroskedasticity-consistent method.

Dependent Variable: UNDERPRICING

Method: Least Squares

Sample (adjusted): 1 214 Included observations: 117 after adjustments

White Heteroskedasticity-Consistent Standard Errors & Covariance

Retour au menu : Investor Sentiment and Short Run IPO Anomaly: A Behavioral Explanation of Underpricing