Comment :

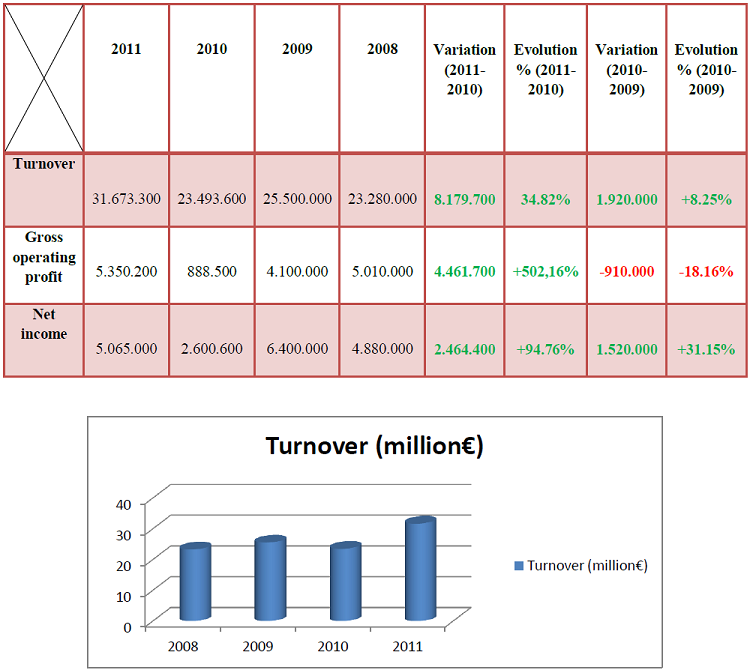

Over the last 4 years the company has clearly increased its benefit in order to establish itself as a leader in the market for protection and security by the holographic technologies. Turnover is constantly growing despite a slowdown in 2010 due to the slowdown of people moving aircraft and the global economy. Responsiveness of the company is seen with an increase in EBITDA of 2010-2011 more than 500%. The company is on track to grow and gain market share on the international scene.

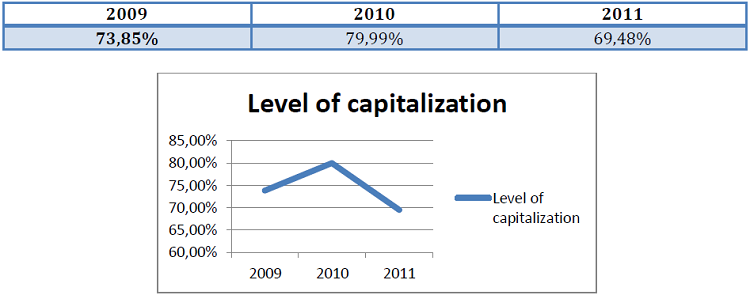

a) Level of capitalization

Comment : The level of capitalization of a company provides a first assessment of the wealth accumulated by the company during its existence. More equity is higher, and more the company has a cushion of assets (land, buildings, inventory, receivables, cash…) to allow possibly repay all its debts (bankers, suppliers, region and state…).

We can notice that the level of capitalization of the company is quite high in recent years. The company holds equity, and the balance after 2010-2011 there was an increase in assets of 48.41%. In addition we can also note that during 2010-2011 the company has grown by over 13% in equity, which shows that the company has invested in new machinery, land … and therefore less likely to be affected by the bankruptcy.

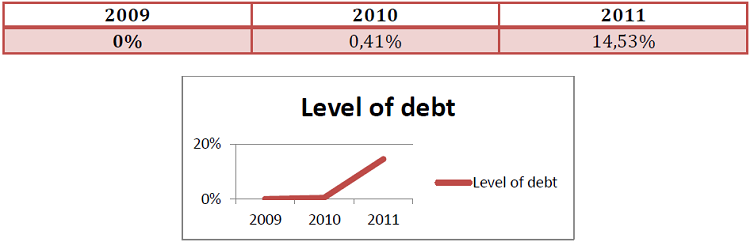

b) Level of debt

Comment : This ratio ensures that the members of a company are more involved financially bankers. If borrowings are substantially more than 100% of the equity, this imbalance may mean that the partners have limited financial means or do not wish to invest in the company.

We can notice that during 2009-2010, the company had a debt level very low because of a shareholders’ investment and the many projects and prospects that the company faced (market banknotes euros, the Chinese market …). In 2011 we see a slowing economy. According to the balance sheet, it is noted that the company has increased by almost 100% in debt, mainly debt with a ratio of 3898%. The company develops and acquires new markets; therefore it invests more and at larger scale (buildings, machines…)

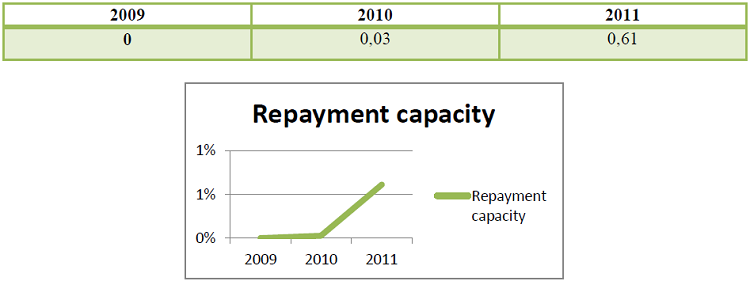

c) Repayment capacity

Comment : This ratio evaluates the theoretical number of years required to repay all of the bank debt of the company. Beyond 5 to 7 years, which is the maximum current bank loans, this ratio can alert the difficulty to repay its bankers.

We can notice that the company is doing quite well in terms of its ability to repay these debts. It has sufficient background to honor these debts, suppliers; social tax … Despite an increase in activity in 2011 due to greater investment, the company still seems to be doing well and shows good management of these resources.

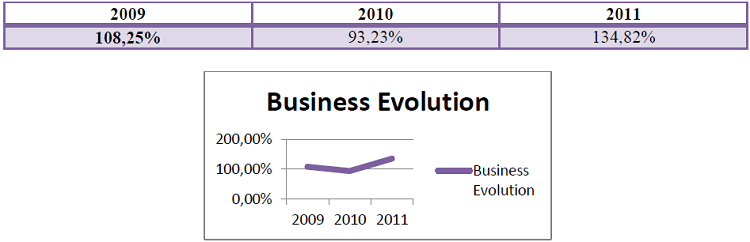

d) Business evolution

Comment : The analysis of the variation of the turnover permit to check if the company has growth at least as important as the French economy in general. Above a positive growth rate of 2%, we can consider that the company manages favorably to “grow” at the same pace or stronger than the average French economic actors.

This ratio shows the evolution of turnover in comparison with the French market. In 2009 and 2011, the results were rather favorable to the company, only remark in 2010 the company recorded figures rather poor in comparison with the French market in general, because of important changes in the economic European Union. But in 2011, the company was able to catch up on time today they can register better results.

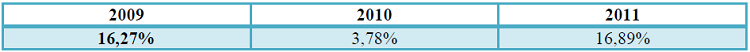

e) Operating profitability

Comment : EBITDA is profit earned by the company through its core business. It ensures that the “core business” of the company is profitable, before taking into account costs indirectly related to daily activities, such as the annual depreciation of the equipment or the payment of interest of bank debt.

We can notice that the company is profitable thanks to its main activity which is the protection of official documents through technology holograms (passports, banknotes …). In 2009 and 2011, the company recorded good results contrast with 2010, when the crisis has had a negative effect on the activity. We can notice that the company has earnings release in 2011, which shows that they were reactive to the situation.

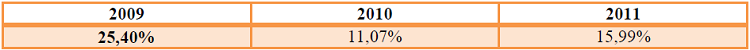

f) Net profitability

Comment: The ratio Net income / turnover considers the ability of the company to reach a final net profit, after taking into account all of the expenses that were incurred by the company throughout the year.

This ratio shows us that the company is well managed and can definitely make profits through the economic situation. The market is well organized and the company plays a key role as a leader of providing holograms to security markets. The company has sustain during this 3 years a growing expansion, 2009 was a better year, but the company still make profits.

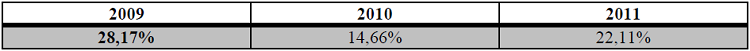

g) Cash flow

Comment : Cash flow gives an indication of the company’s ability to generate enough cash to overall power then maintain or expand its business. Negative cash flow means that the company will tend to have less cash likely “to strangle” gradually its business.

Over the past three years the company has enough free cash to ensure its ultimate profitability. In 2009, it had approximately 95.60 days for the immediate liquidity while in 2011 he only needs more than 67.67 days. This can be explained by a better management in the supply chain:

a) Between 2009 and 2011

o The client passes within 132 days to 161 (174 in 2010)

o The deadline for suppliers from 52 days to 42 days (49 in 2010)

o The weight of stocks of 51 days to 55 days (70 in 2010)

Therefore it may be noted that the company reacted to the situation in 2010 and try to sustain its leadership by managing well the company

Conclusion :

The company “Hologram Industries” has demonstrated reactivity of facing the challenges of the time. Since the events of 2001, security has become a major issue in the global economy. Major changes have enabled the company to attack new markets and expand its activities in parallel. Today it enjoys worldwide recognition and seems on track. The opening of new markets such as China and the development of new countries such as Brazil gives the company the opportunity to grow and further develop global leadership.

The most amazing thing is that the creation of the company leaders wanted to develop communication solutions events but the market did not supported in the 90s, so they decided to invest on the security market. This decision shows the perfect example of a learning organization that manages the change, take risks and also place leaders of the company front of the present in order to insure the future.